Life Insurance Things To Know Before You Buy

Table of Contents4 Easy Facts About Life Insurance Online Explained

depends upon your private requirements. A term life plan makes feeling if you assume you just will need protection for a duration. Term life additionally has a tendency to be much more cost effective than whole life, so it can make good sense for those focused on remaining within a budget plan. "Term insurance coverage benefits somebody who has an insurance policy requirement for just an established number of years,"says Jason Wellmann, senior vice president of life distribution at Allianz Life.

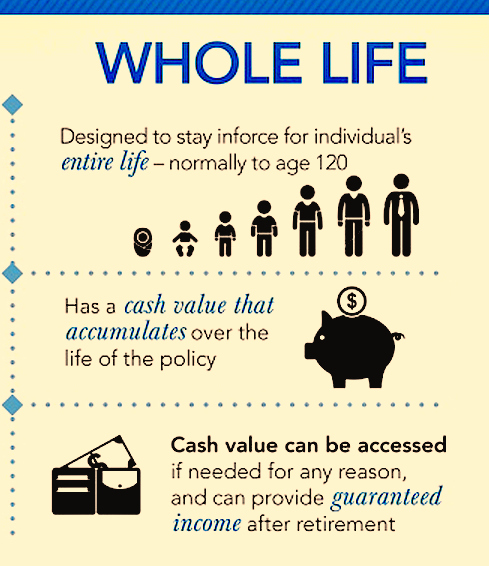

Entire life insurance policy additionally makes sense for those that intend to secure one premium price and preserve that price for as long as they live."The fatality benefit stays in place for the whole lifetime of the guaranteed, as long as sufficient premiums are paid, "Wellmann claims. Entire life also uses a" cash worth"account that interest those wishing to gather a larger pool of cost savings. You can access cash value in the type of a loan or withdrawal from the cash worth. The cash could be utilized for things such as: Assisting with a child's college education, Funding retired life revenue, Paying for emergency expenditures, Just how to select a life insurance policy coverage amount? You may ask yourself,"Just how much life insurance do

I need?" When buying life insurance policy, choosing the best quantity can be tough. Some experts suggest purchasing an advantage that will pay out 7 to 10 times an insurance policy holder's yearly earnings. Working carefully with a life insurance coverage agent can aid you identify exactly how much coverage you need given your special scenario. Whole life insurance Louisville. How much does life insurance policy cost?Average life insurance policy price is a little bit of a misnomer due to the fact that the cost of a life insurance policy policy can differ commonly by individual. Ladies live longer, so they tend to pay lower costs. Much healthier people pay reduced costs than those with some medical problems. You will certainly pay greater premiums if you smoke. People with risky leisure activities-- such as sky diving-- may pay greater costs. Jobs that entail more physical risks can cause higher premiums. If you're looking for low-cost life insurance, understand that term life coverage is

usually generally more affordable whole entire coverageInstance How to minimize life insurance policy? The most effective life insurance policy policy is the one that fully satisfies your needs. Buying life insurance policy is constantly a balancing act in between getting the insurance coverage you need and getting the most effective life insurance policy prices."Determine what is important to your economic plan as well as examine each year."Another important method to conserve is to compare life insurance policy prices. That method, you can locate the finest plan at the best rate. Just how to get life insurance quotes? You have a number of alternatives for obtaining life insurance coverage quotes. One method is to narrow a listing to numerous insurers as well as to acquire specific quotes from each of them, either by calling their offices or utilizing their website

. Getting life insurance coverage quotes online is one of the very best ways to conserve. Among the most basic and quickest means to gather quotes is to make use of a service like the one used by Simply type in your postal code and also you will quickly get several life insurance policy quotes Our site in just a couple of mins. Below are some inquiries to answer: Do you have liked ones relying on your revenue for their well-being? Is there a favorite charity or cause you want to support economically? Do you wish to offer money to cover your final expenses? Relying on your objectives, you might assign one or more people to be recipients. Alternatives may include: All of the survivor benefit arrive in a solitary settlement (Life insurance quote online). Some beneficiaries find it less complicated to get the cash slowly over a period. Some insurers may enable a beneficiary to maintain the fatality benefit

in an interest-bearing account. Beneficiaries can then compose checks versus the money in the account. Unless the annuity is developed for a collection period, any type of staying death advantage continuing to be when the beneficiary passes away will return to the insurer. Term life insurance Louisville. Exactly how does a recipient make an insurance claim? The Insurance coverage Information Institute advises